How to File an Appeal with the IRS

Yes, you can start a dialogue with the IRS if you feel that its findings are incorrect.

The very thought of having to communicate with the Internal Revenue Service about something you believe is an agency error is intimidating to most people. The tax code is massive and often difficult to decipher, and everyone gets at least a little nervous they consider engaging the governing agency.

But there are numerous reasons why you might dispute something that the IRS has communicated to you. You might think, for example, that the law was not interpreted correctly, so a decision may not have been the right one. Or you don’t believe that a collections effort should have been initiated against you, or you feel that your offer in compromise should have been accepted.

But there are numerous reasons why you might dispute something that the IRS has communicated to you. You might think, for example, that the law was not interpreted correctly, so a decision may not have been the right one. Or you don’t believe that a collections effort should have been initiated against you, or you feel that your offer in compromise should have been accepted.

There are three things you need to do first:

- Double- and triple-check any IRS publications that you consulted to make sure you read them correctly, as well as to be sure that you’re very clear on what your position is and why.

- Decide whether you are going to go it alone or whether you would like a CPA or attorney to represent you.

- Prepare to file a written protest to request an Appeals conference.

Note: You may be able to bypass this formal document if you qualify for something like the Small Case Request. Check with us to see which procedure will be appropriate in your case.

Even if you choose to let us guide you through this complex process, you can start gathering information for the written protest. The IRS expects it to contain a great deal of detail, including:

Your contact information,

Your contact information,- A clear statement indicating that you intend to appeal to the Office of Appeals because of changes that the agency suggested,

- The letter that the IRS sent you that outlined the changes it believed needed to be made,

- The pertinent tax period(s) or year(s),

- A list of the items with which you take exception,

- Your rationale for disagreeing, including supporting facts,

- Your signature, of course, and

- A statement and signature from any professional who helped you prepare the protest document.

Talk to us if you’re protesting a lien, levy, seizure, or denial or termination of an installment agreement. These disagreements require a different procedure.

Be Proactive

You may assume that the IRS is always right and therefore may be uncomfortable second-guessing the changes the agency made to your tax return. But you have a perfect right to protest – as long as you’re certain of the rationale for your dispute.

The best way to avoid having to go through this process, of course, is to be exceptionally careful about your tax return in the first place. This requires planning throughout the year and a thorough understanding of all of the information you supply to the IRS. If your return contains more than some simple income and deductions, we’d be happy to work with you from start to finish.

But a letter addressed to you from the IRS? Your first reaction may well be to wonder what you did wrong.

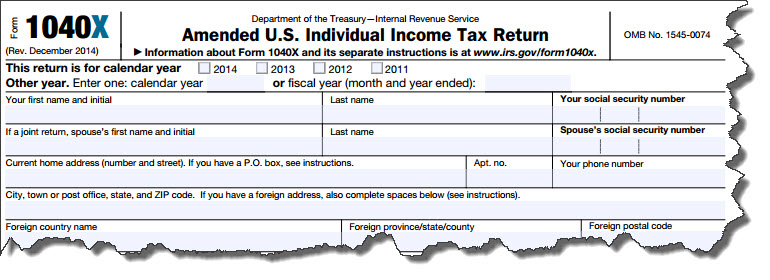

But a letter addressed to you from the IRS? Your first reaction may well be to wonder what you did wrong.  Read through the entire letter at least once and make sure you understand what is being said. Let us know if you are at all unsure of the situation. Your return may have been changed by the IRS, in which case you should compare the modifications to your original return. The agency may also believe that the return was submitted fraudulently and not by you. You’ll be asked to verify your identity if identity theft is suspected.

Read through the entire letter at least once and make sure you understand what is being said. Let us know if you are at all unsure of the situation. Your return may have been changed by the IRS, in which case you should compare the modifications to your original return. The agency may also believe that the return was submitted fraudulently and not by you. You’ll be asked to verify your identity if identity theft is suspected.

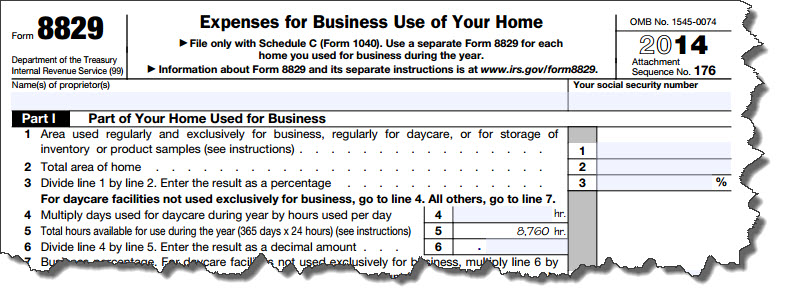

At the same time — whether it’s good or bad — businesspeople have found it easier to do office work at home.

At the same time — whether it’s good or bad — businesspeople have found it easier to do office work at home.

Be discriminating about with whom you share information with online – especially your Social Security number. Just as you should never disclose anything sensitive to someone who calls you on the phone, even if they claim to be with a business you patronize, stay mum if someone approaches you online and asks personal questions. Find the number for the business itself and initiate a call if you believe it might be a legitimate request.

Be discriminating about with whom you share information with online – especially your Social Security number. Just as you should never disclose anything sensitive to someone who calls you on the phone, even if they claim to be with a business you patronize, stay mum if someone approaches you online and asks personal questions. Find the number for the business itself and initiate a call if you believe it might be a legitimate request.

How long after I’ve filed a return can the IRS still order an audit?

How long after I’ve filed a return can the IRS still order an audit?

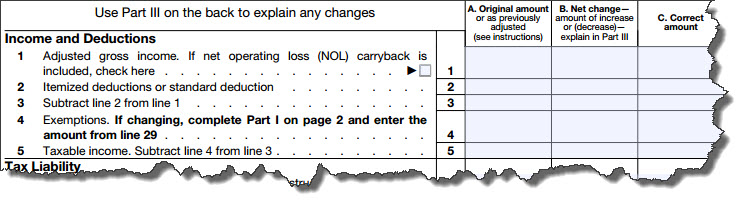

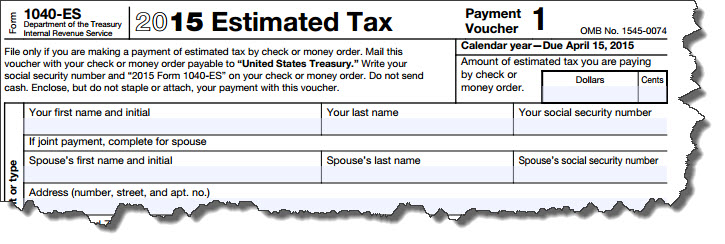

It is true that self-employed individuals have many freedoms not afforded to those who must show up at an office or warehouse or retail outlet at scheduled hours several times a week. But where income taxes are concerned, that envy goes the other direction. Besides not getting benefits like paid time off, health insurance, and retirement plans, independent contractors bear a much heavier load, as they must kick in the money that employers cover for their full-timers.

It is true that self-employed individuals have many freedoms not afforded to those who must show up at an office or warehouse or retail outlet at scheduled hours several times a week. But where income taxes are concerned, that envy goes the other direction. Besides not getting benefits like paid time off, health insurance, and retirement plans, independent contractors bear a much heavier load, as they must kick in the money that employers cover for their full-timers. There’s a good reason why independent contractors are called contractors: they “contract” with companies to provide services. They work for an hourly or by-the-project rate that’s arrived at ahead of time by mutual agreement. There are numerous types of professions that count independent contractors among their ranks, including artists and writers, doctors and dentists, lawyers, accountants, and, well, contractors and subcontractors.

There’s a good reason why independent contractors are called contractors: they “contract” with companies to provide services. They work for an hourly or by-the-project rate that’s arrived at ahead of time by mutual agreement. There are numerous types of professions that count independent contractors among their ranks, including artists and writers, doctors and dentists, lawyers, accountants, and, well, contractors and subcontractors.