It’s not just self-employed individuals who are required by the IRS to pay estimated taxes.

There are numerous advantages to being self-employed. The top benefit that most full-time, must-report-to-the-office employees most envy the most is your ability to establish your own work schedule. You don’t have the commuting expenses, nor the hassle. No endless meetings with co-workers, and no dealing with office politics.

Self-employment has one major disadvantage, though: the self-employment tax. One of the benefits of being a W-2 employee of a company is, well, the W-2, which documents how much you paid into Social Security, as well as the big chunk your employer kicked in.

Others Owe, Too

But estimated taxes are not just for the self-employed. They’re owed by anyone who has at least some income that isn’t subject to withholding by an employer. For example, if you receive interest or dividends, rent, or income from selling an asset, you are required to pay estimated taxes.

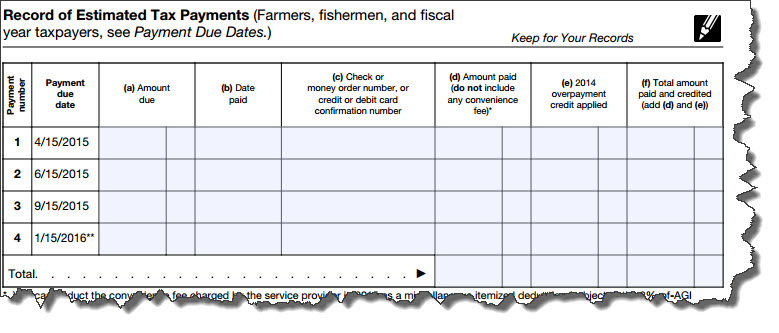

Figure 1: The IRS establishes a payment schedule for your estimated tax payments.

In addition, if you’re not deducting enough income tax deducted from your salary, pension, or other income, you’re obligated to send the IRS a payment four times a year. This is why it’s so important that you enter the correct number of allowances on your W-4 (and even add an additional amount if necessary), and that you track all income. Failure to submit enough income tax dollars prior to filing your 1040 – and by the IRS’ scheduled deadlines — will result in penalties, even if the IRS owes you a refund.

How to Pay

The form you use to submit your estimated tax payments depends on what type of business entity you are. If you are a sole proprietor, partner, S corporation shareholder, and/or a self-employed individual, you’ll need to make quarterly estimated payments if you think you will owe $1,000 or more (after you subtract withholding and refundable credits) or more come filing time. You would use the Form 1040-ES (Estimated Tax for Individuals) to calculate and pay. Corporations should use the Form 1120-W (Estimated Tax for Corporations) if they expect to owe $500 or more when they file.

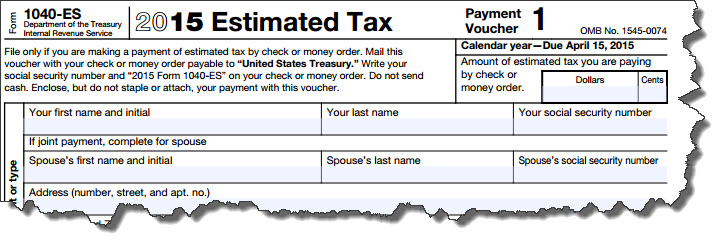

If you are sending a check or money order, you can fill out and print the vouchers included at the end of Form 1040-ES on the IRS site.

Figure 2: If you are sending a check or money order to make estimated payments, you can use these voucher forms found on the 1040-ES page.

There are multiple ways to pay estimated taxes electronically, either by credit or debit card, or by withdrawal from a bank account. They’re listed here, and they include EFTPS (the Electronic Federal Tax Payment System), a free service provided by the U.S. Department of the Treasury.

As Always, Exceptions

There are some individuals and businesses to whom these mandates don’t apply. Farmers and fishermen, as well as some household employers and higher-income taxpayers have different rules that are explained in the Form 1040-ES instructions.

Also, you’re not required to pay estimated taxes if:

- You were a U.S. citizen or resident alien for all of the previous year, and

- You had zero tax liability for the full 12 months of the previous year.

How to Estimate Your Estimated Taxes

That’s the tricky part, especially if you are self-employed or for some other reason don’t know for a fact how much you’ll owe in income tax for the current year. You can use the previous year’s return as a guide, but there have, of course, been tax code changes since then. And your income and deductions may well be different this year.

This is really an area where you should sit down with us and make a plan. This might involve running monthly or quarterly reports, creating projections, etc. These are good habits, especially if your income is unpredictable. Year-round tax planning will not only help you make those quarterly payments – it will provide a clearer view of your company’s overall financial health.