For the first time, all taxpayers must include information about their health care coverage to the IRS on their 2014 Form 1040.

Another year, another tax form or two.

2014 was the first tax year that the Individual Shared Responsibility Provision (SRP) of the Affordable Care Act (ACA) went into effect. That means all taxpayers were required by law to have had minimum essential coverage for all 12 months, which includes:

- Government-sponsored programs like Medicare,

- Employer-sponsored coverage,

- Individual coverage purchased through the Health Insurance Marketplace (either HealthCare.gov or your state’s exchange) or directly from an insurance company, or

- Grandfathered health plans (some that existed before the ACA was passed and have not changed since).

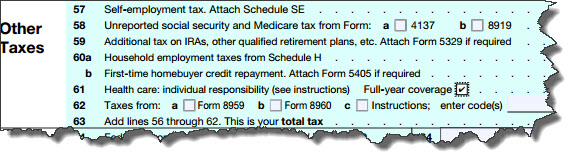

If you have such health coverage, all you have to do is check the “Yes” box on the new line 61 on the 2014 Form 1040.

Figure 1: The 2014 IRS Form 1040 now asks about your household’s health coverage.

A New Form

If you bought a plan through the Health Insurance Marketplace, you should have received an IRS Form 1095-A by January 31, 2015. If you have not received it by now, contact the marketplace where you signed up for coverage; don’t contact the IRS.

The Form 1095-A, which is issued by the marketplace, contains several types of information, including details about you, your policy, household individuals covered, your monthly premiums, and any advance credit payments you received (this would have occurred during enrollment).

Premium Tax Credits

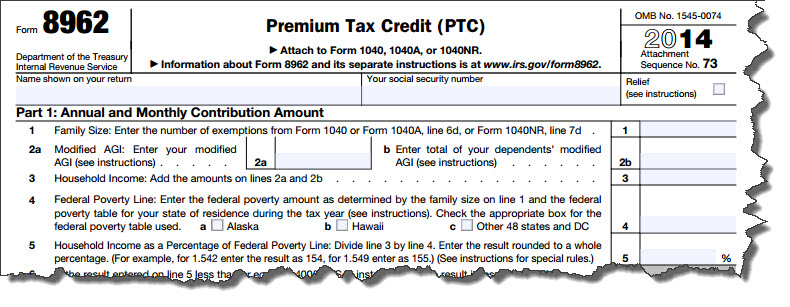

The ACA built in provisions for individuals who could not afford even a lower-tier health insurance policy – Premium Tax Credits (PTC) — to ensure that all taxpayers would be able to buy coverage. This formula involves comparing your income to the Federal Poverty Line (FPL). Your marketplace should have notified you about your PTC status. However, if your household situation changed between the estimates made during the enrollment period and your IRS income tax preparation (due to divorce, income increase or decrease, etc.), you’ll need to see if you are still eligible. To do so, fill out a Form 8962.

Figure 2: You’ll need to complete a Form 8962 to see if you can claim the Premium Tax Credit.

Basically, the IRS is trying to calculate the amount of tax credit you should receive. If there is a difference between any advance credit payment made and the new, calculated Premium Tax Credit, you may receive a refund – or be required to repay the excess.

Warning: The Form 8962 is a complicated new form, so there is bound to be some confusion. You may want our help with it.

Exemptions and Penalties

If you did not have health insurance in 2014, the IRS will assess what’s called an individual shared responsibility payment. In other words, a penalty. For tax year 2014, that payment would amount to whichever of these is greater:

- 1 percent of the household income that is above the tax return filing threshold for the taxpayer’s filing status, or

- The family’s flat dollar amount, which is $95 per adult and $47.50 per child (under age 18), limited to a family maximum of $285.

There are exceptions, though. For example, you may be granted an exemption if your household income is below the return filing threshold or if there was only a short coverage gap. If you have received an exemption, you’ll need to complete and file a Form 8965 with your 1040.

Note: The marketplace grants certain exemptions, while others are claimed on your tax returns. It depends on the exemption. If you think you are entitled to an exemption and have not been given one, please contact us right away.

Most taxpayers will simply be able to put a check in the Full-year coverage box on line 61 of the 2014 1040. But if you bought a policy through the Health Insurance Marketplace – either federal or state – for 2014, we strongly urge you to contact us. There will undoubtedly be many taxpayers puzzling over the ramifications of this new ACA provision. You don’t have to be one of them.