Even if your 2014 refund hasn’t hit the mailbox yet, it’s time to get a jump on your 2015 taxes.

What does the phrase “tax planning” mean to you?

- Hurriedly giving charitable donations in December to try to knock down your total income tax obligation

- Setting aside time for tax preparation as soon as your tax forms come in after the first of the year

- Making tax planning a year-round element of your larger financial planning

There’s nothing wrong with the first two here, but we also hope you’re practicing #3. If not, here are five ways you can do that.

Run your financial reports conscientiously.

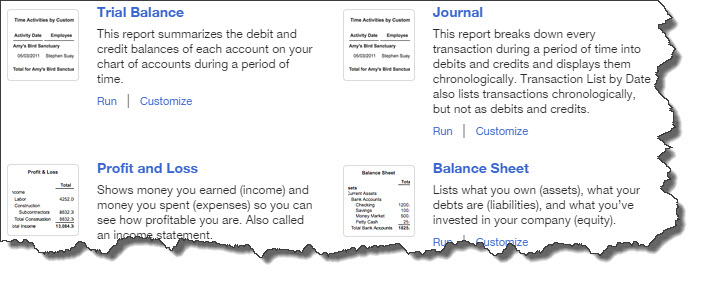

Figure 1: Reports are a critical part of your year-round tax planning. We can create and analyze the standard financial reports you’ll need.

All of that hard work you do entering transactions and receiving payments conscientiously pays off in reports that can help you make better business decisions every day. But reports are also an important element of your tax planning. There are many simple ones that you’ll want to generate regularly to keep an eye on your income and expenses, but some, like the Trial Balance and Statement of Cash Flows, are more complex and can require a professional’s interpretation.

If you’ve not already done so, talk to us about setting up a regular schedule for these standard financial reports, either monthly or quarterly. We can explain how the insight you receive can have an impact on your tax obligations.

Consider your “green” options. Energy conservation is not just a good idea — it can help you save money on your taxes. The government makes a number of energy credits available to businesses and consumers who install and use products that are energy efficient. You can get more information here.

Watch expenses like the proverbial hawk. Business expenses will offset your income and help you lower your tax bill, but they need to be the right expenses. And they need to be documented comprehensively and accurately.

Technology can be your friend here. There are applications that help you rein in travel expenses, for example. You can lay out your policies within them, and they will flag expenses that are out of your reimbursable and/or billable range. Others help you track and manage receipts. There are also numerous time-and-billing applications that will help you ensure that all hours worked are recorded and billed back to the appropriate customers.

These solutions are easy to use and inexpensive, and they can help you trim the fat and charge your customers for the expenses you incur for them. We can help you explore and implement what’s available.

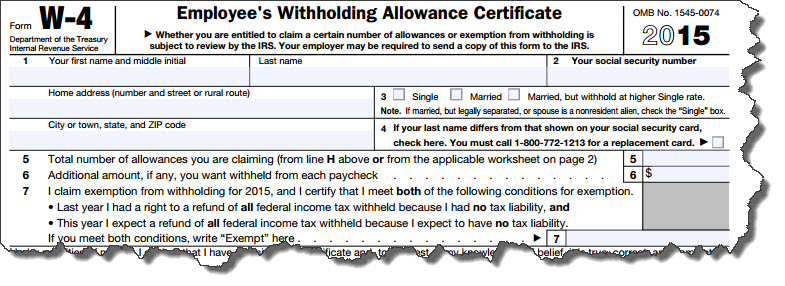

Are you getting too much of a refund, and you’re tired of loaning the government your money without getting any interest? Or conversely, are you having to pay too much at filing time? Evaluate your withholding to determine whether you should be claiming more or fewer allowances. You can talk to us about this. If you need to complete a new Form W-4, you can find one here.

Figure 2: Allowances are often the culprit if you’re regularly receiving a large refund or you frequently have to pay at filing time. We can help you evaluate your situation.

Use a recommended small business accounting product. Whether it’s desktop software or a cloud-based solution, there’s simply no reason why you should still be using Excel and paper. You need solid financial information year-round that culminates in a thorough, accurate set of forms and schedules come tax time. In fact, your income tax obligation is good enough reason to invest a modest amount of money and some training time to automate your finances. There are many other benefits, but tax planning is a significant one.

We want to help you take some of the dread and anxiety out of tax deadlines. Setting up a year-round planning strategy will do just that.