The word “account” can mean more than one thing in QuickBooks Online.

Before you started doing accounting tasks for your small business, the word “account” simply referred to your accounts at a financial institution – checking, savings, credit cards, etc. QuickBooks Online lets you access these same kinds of accounts via the internet and download their transactions.

But “account” has an additional meaning in accounting. Your Chart of Accounts is a list of accounts that will be used in transactions to categorize them and create accurate reports. It is a critical element of your bookkeeping and needs to reflect your company’s business structure correctly.

Where does the Chart of Accounts come from?

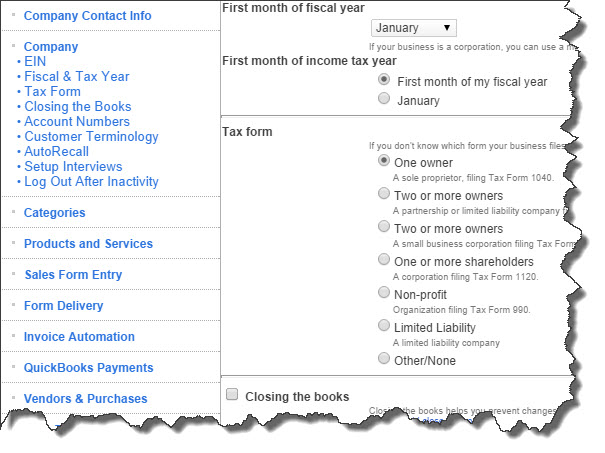

QuickBooks Online builds your Chart of Accounts based on the questions you answer when you first start using the application. You can revisit them by clicking on the small wheel icon in the upper right corner of the screen and selecting Company Settings.

Figure 1: One of the reasons you’re asked to respond to so many queries about your company when you began using QuickBooks Online is so that the application can build an accurate Chart of Accounts for you.

How is the Chart of Accounts organized?

The Chart of Accounts is typically divided into several account types (each of which contains an individual account), including:

- Assets. What you own

- Liabilities. What you owe

- Income. What you earn

- Cost of Goods Sold. What it costs to create products

- Expenses. Additional costs required to operate your business

Do I need to assign transactions to accounts manually?

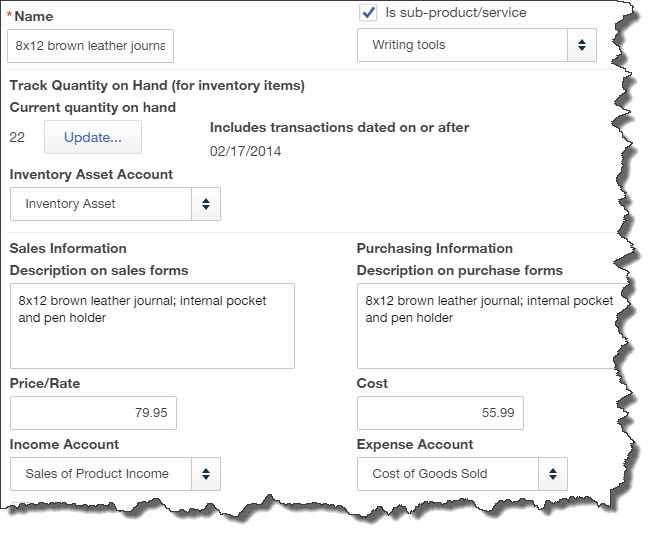

Not usually. QuickBooks Online knows, for example, that an invoice will go to the Accounts Receivable account, so there’s no field for Account on invoice forms. The same goes for purchase orders; they’re assigned to Accounts Payable. On the other hand, you must select an account when entering expenses or writing checks, and your product and service records must be assigned to the correct accounts.

Figure 2: When you create product records, you’ll need to assign the correct accounts from your Chart of Accounts. QuickBooks Online supplies a drop-down list of your options.

Do I need to number my accounts in the Chart of Accounts?

No. QuickBooks allows this, but you shouldn’t try it on your own. Let us assist you.

Can I edit the Chart of Accounts?

Yes. Again, QuickBooks allows this, but please contact us if for some reason you think editing is necessary.

Do accounts appear on reports?

Yes, primarily financial reports like Profit & Loss, Statement of Cash Flows, and the Balance Sheet. These are reports that we should run for you periodically.

How do I see my Chart of Accounts?

Click the small gear icon in the far upper right of the screen, and then select Chart of Accounts. If you want to familiarize yourself with the types of transactions each contains, highlight one and click the Register button in the upper right.

The Other Accounts

On to more familiar territory that you can actually work with yourself: the accounts you hold with financial institutions.

Since those accounts are tracked in the Chart of Accounts, you’ll have to access that part of the site to set them up. But please restrict your activities here to your own financial accounts.

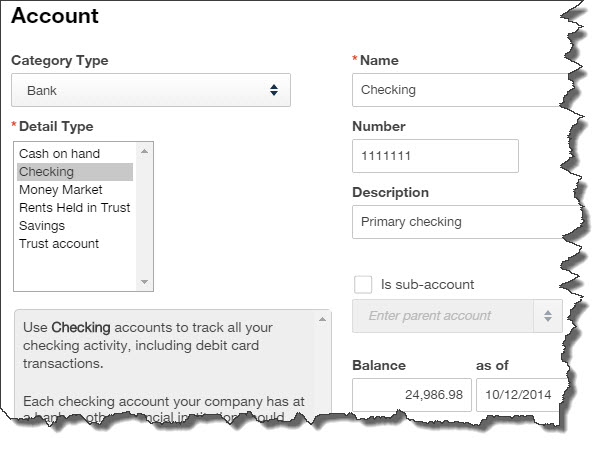

Click the small gear icon in the far upper right and then select Chart of Accounts. Click the New button in the row of activity icons. This window opens:

Figure 3: You should set up a separate account in QuickBooks Online for each active account that you have at financial institutions.

Repeat this process for every account.

How do I set up QuickBooks Online to download transactions from my bank?

Click Transactions in the left vertical pane and then click Banking. Click the Add Account button in the upper right. Choose one of the banks listed or enter the URL for your bank in the field at the top. Enter the user name and password you use to access that account online. If you’ve never done that, we can walk you through it.

You’re now connected to your account at your financial institution and can download transactions as they come through.

There are many benefits of using online banking in QuickBooks Online. Your accounting records will be more accurate. You won’t have to enter transactions twice. And you’ll always know what your real balance is.

If you’re new to online banking, we suggest you let us help you get started. It’s not difficult once you get going, but dealing with transactions once they’re downloaded (reconciling accounts, etc.) takes some learning time. If you make the effort, though, you’ll find you’re saving time and getting a real-time, accurate view of your financial status.