You’re not required to use statements in QuickBooks, but they help bring unpaid amounts to the attention of your customers.

Collecting outstanding payments is probably one of your least favorite tasks as an accounting manager. QuickBooks Online helps you keep track of these debts in many ways, like through the Income Tracker and Collections Report.

There’s another tool that isn’t used strictly for reminding customers of overdue invoices, but it can be effective in that endeavor: the QuickBooks Online statement. There are three types:

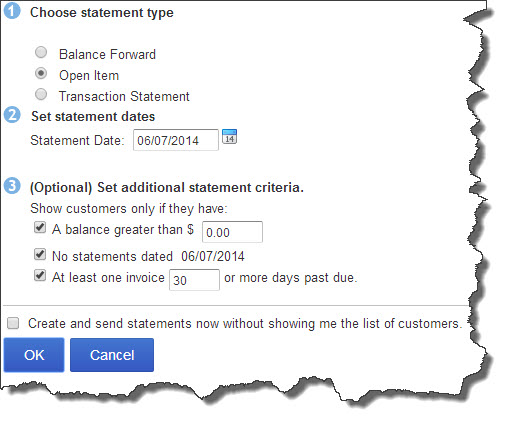

- Balance Forward (lists all activity within a specified date range),

- Open Item (only includes unpaid transactions), and

- Transaction Statement (displays the receivables total and amount received within a stated period).

Figure 1: You can choose from among three different statement types in QuickBooks Online and select additional options.

QuickBooks Online’s Open Item statement would be most useful in collecting outstanding payments. There are two ways to get there. If you’re just sending one to a customer you know has past-due invoices, you can click on the Customers link in the left vertical pane and hover your cursor over that individual or company to highlight it. Then click the arrow next to the drop-down list in the ACTION column and select Send Statement.

If you’re sending multiple statements, click the “+” sign at the top of the screen; and then select Statements. Select Open Item, change the date if necessary, and check or uncheck the boxes below if needed. Click OK.

Note: QuickBooks Online gives you the option of creating and sending statements without looking at the list of selected customers. We do not recommend this. If your criteria have pulled in someone who shouldn’t receive a statement, your unnecessary mailing to them may be annoying.

The next screen will display a list of all customers who met your criteria. If you think you may have incorrectly defined your set of customers, click Change to return to the previous screen. You can also review QuickBooks Online’s Statement List (a report).

Note: If there are missing statements, check the original form’s date. Extra statements? Make sure you sent an invoice. In both cases, it’s possible that you’re trying to include a sub-customer. Still having problems? Let us help.

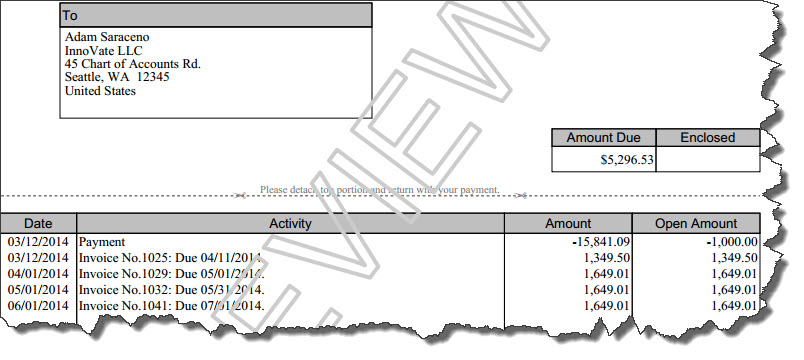

The right side of the screen gives you more information about each, Balance Due and Delivery Method (you can edit the latter if you want). Click the Preview button by each to see what the statement will look like.

Figure 2: Before you print or email statements, you can get an advance look at their layout and content.

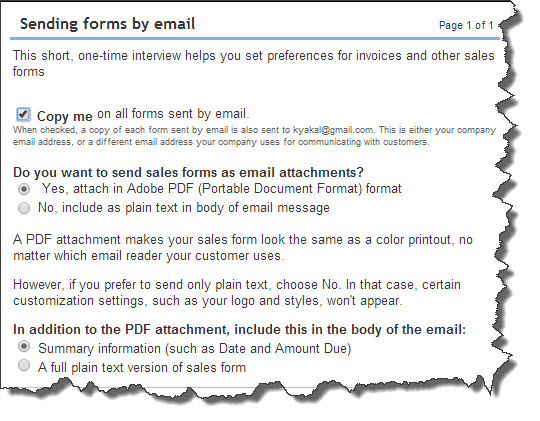

When you’re satisfied that everything is correct, click Create/Send Selected Statements. If you’re emailing some statements and haven’t yet specified your form delivery Preferences, a QuickBooks Online Mini-Interview window should open, letting you indicate whether you:

- Want to be copied on outgoing sales forms,

- Want invoices sent as PDFs or plain text in the message body, and/or

- Want summary information or plain text included in the message body if you send PDFs.

Figure 3: This Mini-Interview asks for your sales form delivery Preferences.

The next page will display a message telling you that statements are ready to print, if you’ve chosen that option for any of your customers. If there is a problem with any emails that were dispatched, you’ll be notified on the QuickBooks Online home page.

Note: Statements are not new transactions. They simply report on transactions that have already occurred. Talk to us if you have any questions about which form to use in a given situation.

If you don’t like the look of your statements, you can customize them. Click the small wheel icon in the upper right corner and select Company Settings | Form Delivery | Customize Forms. To see the Preferences that relate solely to statements, go to Form Delivery | Statements.

The timing and frequency of statements are both important. Send too many, and you might confuse customers. As we said before, you don’t have to send statements at all. The Open Item statement, though, can be an element of your ongoing efforts to get paid faster and improve your critical cash flow.