Oops! Did you determine that you made an error on an income tax return that you already filed? It’s not unusual. That’s why the IRS has a special form that will fix it.

Maybe a 1099 that you had forgotten about came in after you’d filed your income taxes for the previous year. Or a big business deduction slipped your mind. Or as you glanced through your return before filing it, you noticed that one digit in your Social Security number was incorrect.

Sometimes, post-filing errors are your own fault and sometimes not. Whatever the reason, you should file an amended return as soon as you discover the error, because it takes some time to get it processed. The IRS recommends you file a Form 1040X when you need to register a change – or changes — in your filing status, income, deductions, or credits.

Note: Keep in mind that there are exceptions to the general rules and additional forms that may be required depending on your situation. Also, there are some errors that, for numerous reasons, don’t warrant an amended return. So please talk to us before you file one.

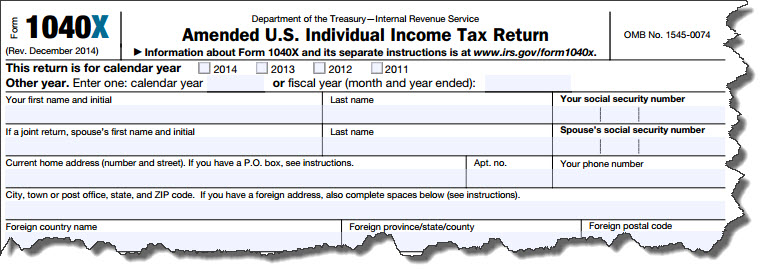

Figure 1: You’ll need to file an IRS Form 1040X to correct a Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR-EZ.

Though we strongly urge you to let us help you prepare and submit an amended return, here are answers to some questions you may have about the process.

What’s Needed: If you need to file an amended return, you’ll have to get a paper copy of the IRS Form 1040X. Besides the form itself and IRS instructions, you’ll need your original return and all of its supporting forms, schedules, worksheets, and instructions.

Where It Goes: Even if you originally filed electronically, you’ll have to complete and submit this the old-fashioned way: through the U.S. Mail. (See page 12 of the IRS instructions for this form to find the appropriate mailing address). Note: If you have discovered errors in more than one year, you’ll have to submit separate 1040X forms in separate envelopes.

How Long You Have to Submit It: The IRS wants to see your 1040X within three years of the date that your original form was filed (including extensions) or within two years of actually paying the tax – whichever date is later.

How Long It Takes the IRS to Process Your 1040X: It may not even show up in the IRS’ system for three weeks. Expect to wait up to 16 weeks for the change to be completed.

How You Can Check the Status of a 1040X: The IRS provides an online tool called Where’s My Amended Return? , which only has updates on certain types of amended returns. You can also call an automated toll-free number (866-464-2050).

What the IRS Does If It Has Questions About Your 1040X: It will contact you through the U.S. Mail.

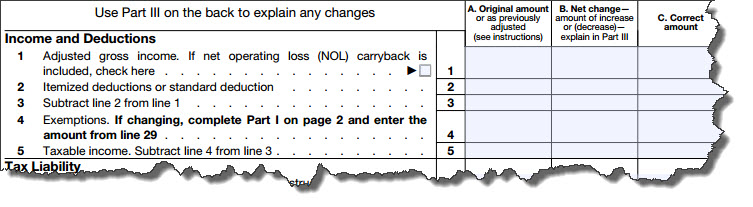

Figure 2: The IRS Form 1040X is structured differently from the other forms in the 1040 family. It will actually replace your original return.

The Form 1040X is not as lengthy as the 1040, but it in essence becomes your new tax return for the year. You’ll supply your original entry or any adjustment that the IRS has already made in one column and then the new amount in another, with the difference in between.

Keep in mind that an amended federal form may have an impact on your state return. We can help you determine this and advise you on how to proceed.

You know how important it is to get everything right on your income tax return. Accuracy is just as critical – if not more so – when you file an amended return. You don’t want to have to correct your corrections, and we don’t want you to, either. So let us know if it looks like a Form 1040X is in your future.