Be prepared for a mountain of paperwork, much of it related to income taxes.

Adding your first employee to your small business comes with good and bad news. The good, of course, is that you’re succeeding so well that you need full-time help. You’re hopeful that this new individual will being new energy and fresh ideas into your growing company.

You probably worry, though, about finding the right person. And you wonder how much your own workload as an employer will grow.

You’re smart to be concerned about both issues. The first has a lot of gray area, but the second – at least where company income taxes are concerned – is very straightforward and clear. The IRS spells out your responsibilities and expects that they will be followed to the letter.

Here’s some of what you’ll need to do:

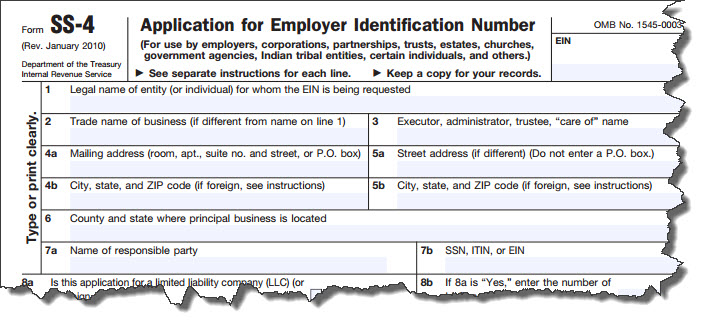

Get an Employer Identification Number (EIN). Sometimes called Employer Tax ID or Form SS-4. You’ll use this for your interaction with the IRS and with state agencies.

Figure 1: Your Employee Identification Number is as critical to your business life as your Social Security number is to your personal life.

Set up your accounting system to accommodate withholding taxes. If you’re using QuickBooks, this is fairly easy. But it can be risky to modify the Chart of Accounts unless you’re absolutely sure of what you’re doing. Let us help you with this initial setup. You’ll need federal and state (if applicable) income tax withholding accounts. You’ll use these in much of your payroll work, like financial statements and expense-tracking.

Ask your new hire to complete the required IRS forms. Your employee must also fill out a W-4 form, which you’ll then submit to the IRS. This will guide you in withholding the correct amount of tax from the employee’s paycheck. The I-9 form must also be completed by every new hire; it verifies their citizenship or eligibility to work in the U.S.

Register the employee with your state’s New Hire Reporting Program. Newly-hired or re-hired employees must be reported to the state within 20 days of their hire date.

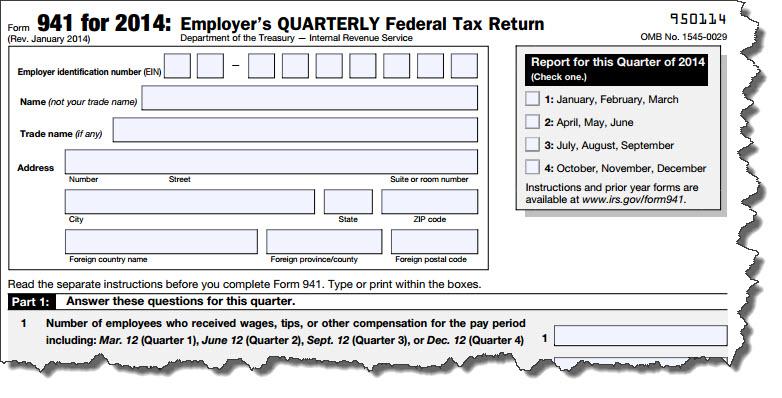

File your quarterly tax returns. If your employees have a portion of their pay withheld for income taxes, Social Security and Medicare taxes, you must file a quarterly Form 941. There are other IRS forms in the 94x series; we can help you determine what you need to file – and how to file.

Figure 2: It’s very important that you fulfill your payroll tax responsibilities four times a year. The IRS assesses penalties for not doing so.

Of course, you’ll have other regularly-scheduled tasks to complete related to the IRS and any required state and local taxes. If you have never hired an employee before (and even if you have), let us sit down with you and go over everything. We can put together a calendar outlining what’s due, and when.

Don’t get discouraged. The early setup can be time-consuming and labor-intensive, but if you build the right foundation, you’ll eventually fall into the rhythm of being an employer.